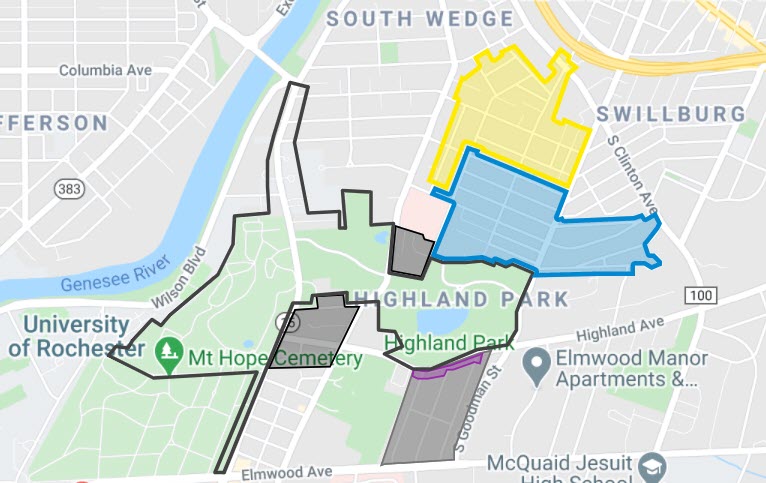

Highland Park Neighborhood National Register Historic Districts

The Highland Park Neighborhood (HPN) has two unique historic districts within its boundaries, Gregory Tract Historic District (yellow) and Ellwanger Barry-Highland Park Neighborhood Historic District (blue). A portion of HPN, south of Highland Hospital, is part of the Mt. Hope-Highland Historic District (gray). All three districts have been approved by the State of NY and have been added to the National Register of Historic Places.

Homeowners within all three historic districts can now take advantage of the New York State Historic Homeowners Tax Credit program. This program helps defray the costs of regular home repairs and upgrades. It provides a credit off your NYS income tax worth 20% of qualifying costs. Qualifying costs include but are not limited to: interior and exterior paint, porch repair, roofs, electric, HVAC, floor refinishing, new kitchens and baths, exterior carpentry, etc.

Resources

NYS Historic Homeownership Rehabilitation Tax Credit:

Click here to find the program requirements, FAQs, info handout, and application forms and instructions.

To answer questions about your application or status of your application, contact:

Christina Vagvolgyi

Coordinator, Incentives & Planning Unit

[email protected]

518-268-2217

Landmark Society’s Old House Help:

Click on this page, on The Landmark Society’s website, to find information on the tax credit program and links to resources for homeowners, and a recorded, generic (not historic district specific) version of the tax credit workshop. Information on this webpage includes; Contractor Request Form link, Rehab Rochester link, National Park Service’s Preservation Briefs link, and information about Landmark’s tax credit consulting services.

State’s Cultural Resource Information System (CRIS):

Click here to find the database where all the information and full copies of the historic district nominations live. You can sign in as a guest and then search from the top bar or scroll on the map to the location where you want to look. You can also search by county / municipality on the side search options.

The projects to establish and finalize these historic districts within the Highland Park Neighborhood were funded through generous grants, company donations, and personal donations. Thank you to our generous donors!